Tax IDs can now be entered at the branch level for billing purposes.

To Enter a Tax ID at the Branch Level:

1. Select Company Setup under the Admin tab.

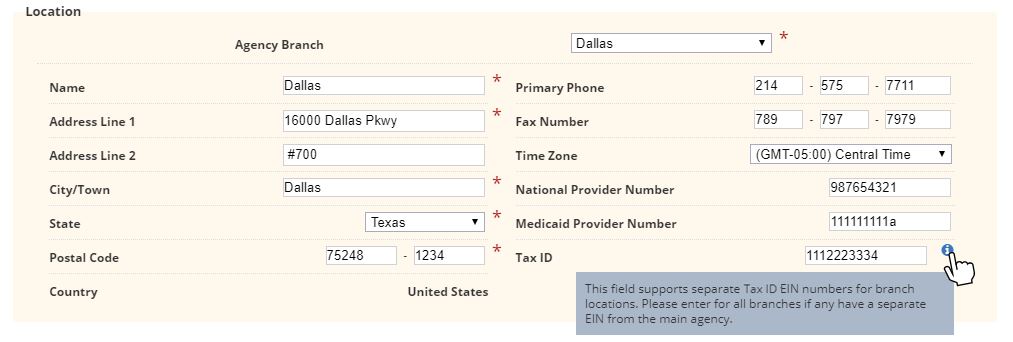

2. On the Information tab, scroll to the Location section.

3. Enter a Branch Tax ID in the Tax ID field and click Save.

4. To enable Branch Tax IDs to automatically populate on billing invoices and claims, add Branch Tax ID as a payment source using the instructions listed below.

To Add Branch Tax ID as a Payment Source:

1. Under the View tab, hover over Lists, and select Payment Sources.

2. Click the Payment Source button in the top right corner to add a new payment source, or edit an existing payment source. To edit an existing payment source, select Edit in the Action column to the right of the payment source.

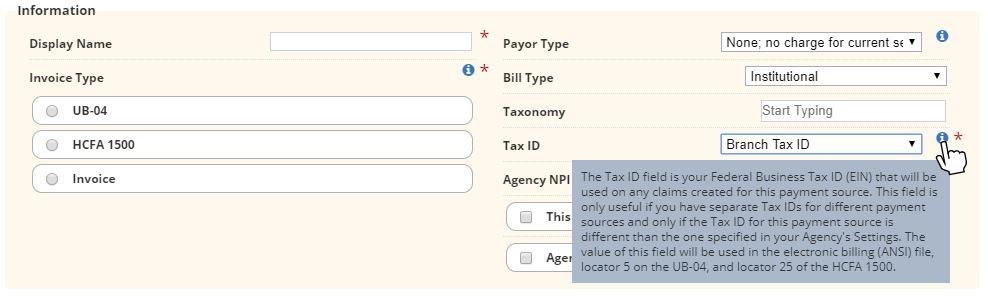

3. In the top right corner of the Information tab, select Branch Tax ID in the Tax ID field drop-down menu. Selecting this option will populate the Branch Tax ID on paper claims and ANSI files for both UB-04 and HCFA 1500 formats.

4. Click Save to complete the process.

Updated on 9/17/2019