Agencies in Indiana can now submit daily occurrence codes to collect overhead payments from Indiana Medicaid programs.

By calculating daily care occurrences for claim submission, this feature streamlines billing processes and facilitates seamless claims processing for maximum reimbursement.

This feature applies occurrence codes for each date or date range that qualifying services are rendered. The overhead daily rate is not applied to the claim, but reflects receivables in the Net Due column of the Claims History screen.

Selecting the overhead rate calculation statement for a payment source activates the following functionality:

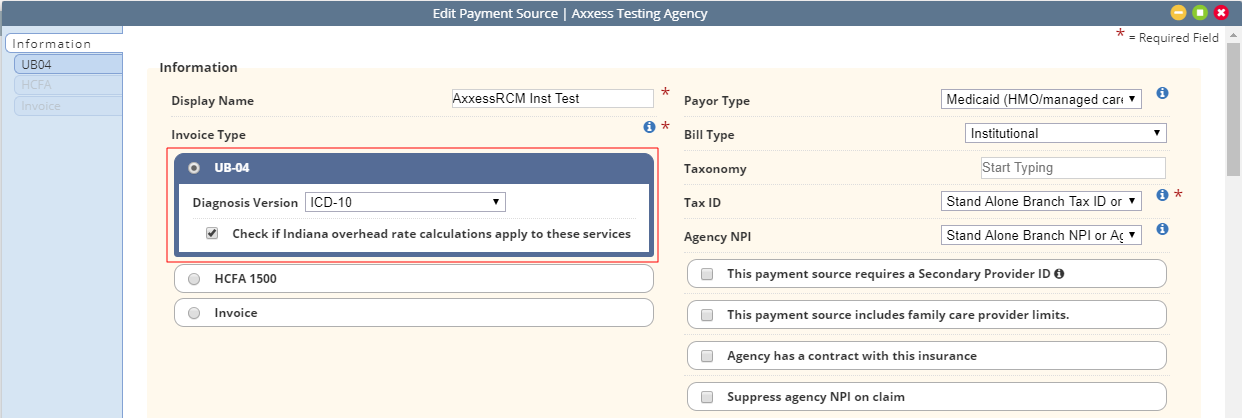

The overhead rate calculation statement can be selected when creating a new payment source or by editing an existing payment source.

To create a new payment source: Create tab ➜ Payment Source ➜ Invoice Type ➜ UB-04

To edit an existing payment source: View tab ➜ Lists ➜ Payment Sources ➜ Edit ➜ Invoice Type ➜ UB-04

Under Invoice Type, select UB-04 and check the box next to Check if Indiana overhead rate calculations apply to these services. Click Save and navigate to the UB-04 tab to continue the process.

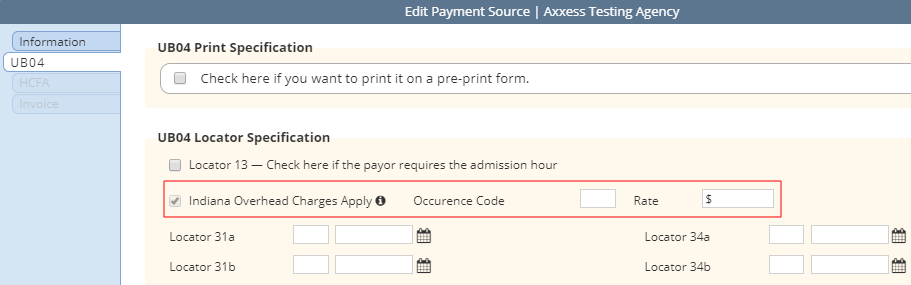

Checking the Indiana overhead rate calculations box adds a line item to the UB-04 Locator Specification section on the UB-04 tab. The new line item reads Indiana Overhead Charges Apply. (This line item is read-only. To remove Indiana overhead rate calculations, navigate back to the Information tab and de-select the box under UB-04.)

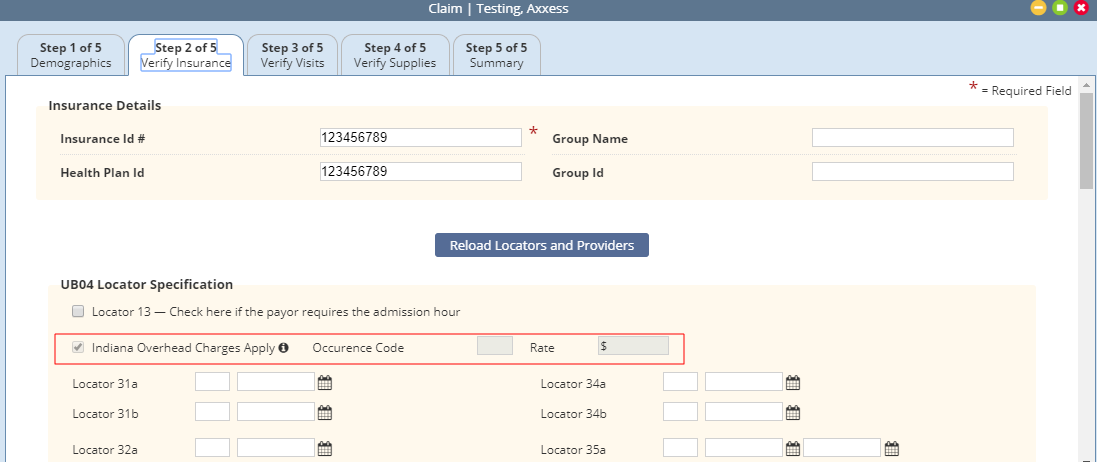

Enter the occurrence code (currently 73) and the daily reimbursement rate next to the new line item.

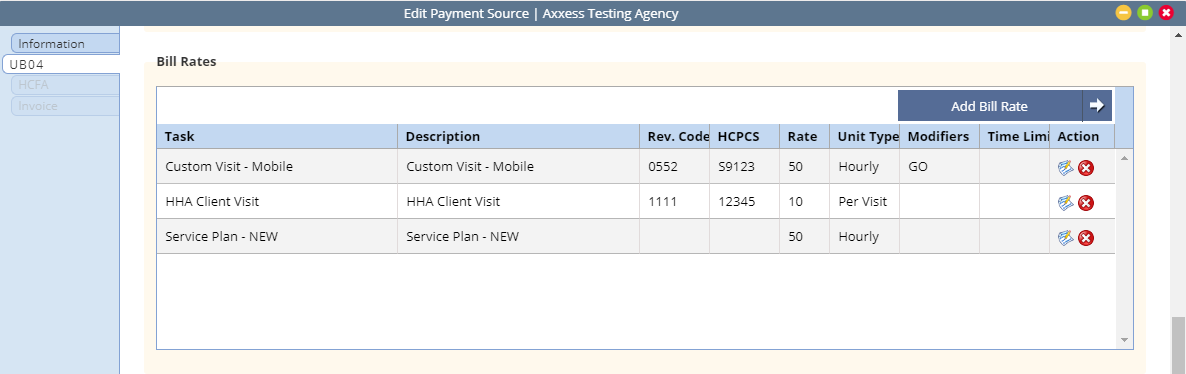

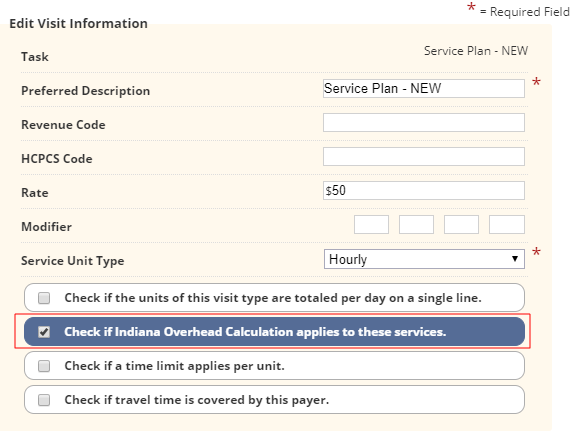

Add/edit bill rates to indicate which rates should include overhead rate calculations.

In the Add/Edit Visit Information window, check the box next to Check if Indiana Overhead Calculation applies to these services.

Billing ➜ Outstanding Claims ➜ Step 2 Verify Insurance

Payment sources with Indiana overhead charges will display the Indiana Overhead Charges Apply line item in Step 2 of the claim verification process. This line item is read-only. Adjusting a payment source’s Indiana overhead charges must be done in the payment source setup.

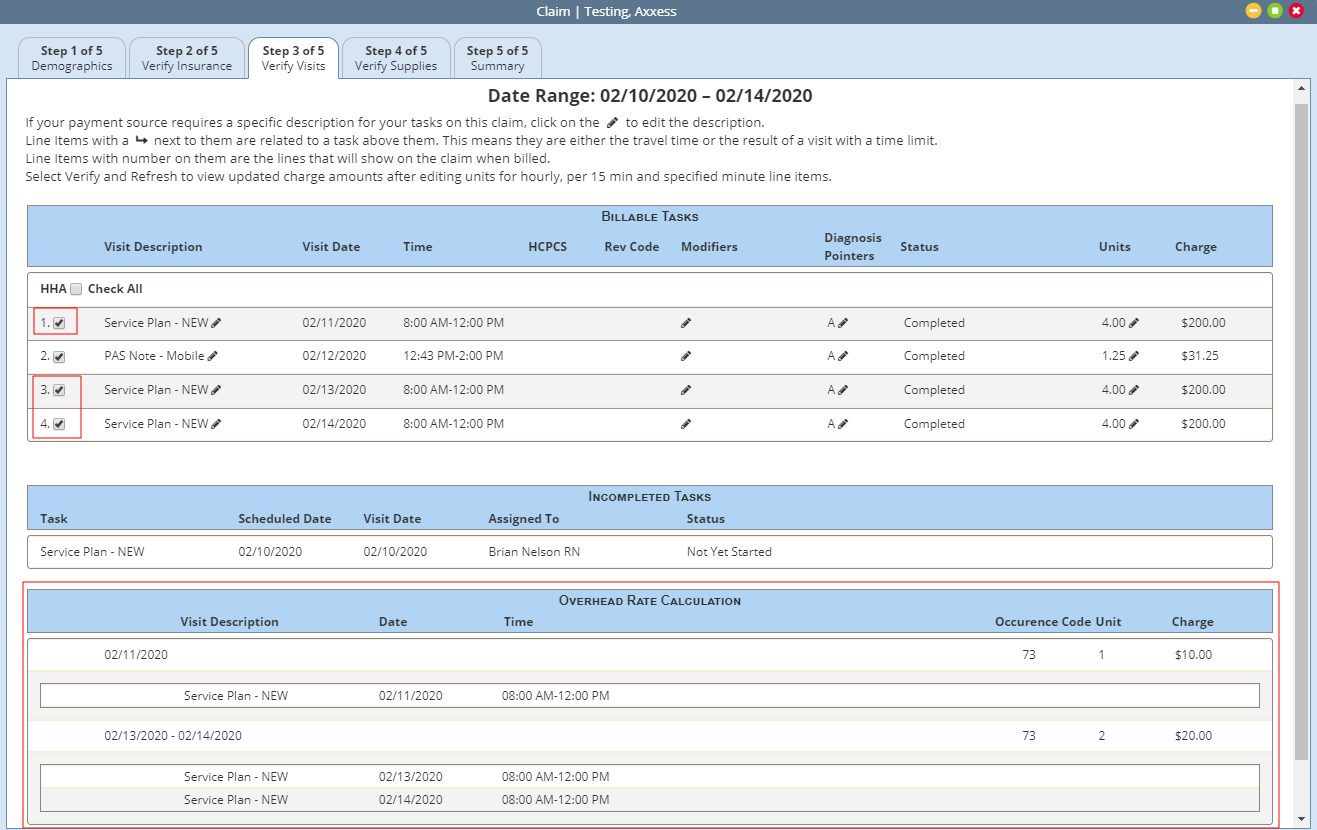

Billing ➜ Managed Care ➜ Outstanding Claims ➜ Claim ➜ Step 3 Verify Visits

Payment sources with Indiana overhead charges will have a new section labeled Overhead Rate Calculation in Step 3 of the claim verification process. This section displays a list of all billable tasks with the Indiana Overhead Calculation statement selected in their bill rate setup.

The tasks will be grouped by individual dates or date ranges. Since the agency receives one overhead rate calculation per day of qualifying services, the number of tasks listed may not match the number of units.

Examples:

Single day with multiple qualifying services provided will only display one unit and charge.

Date range will calculate one unit and charge for each qualifying date in the date range.

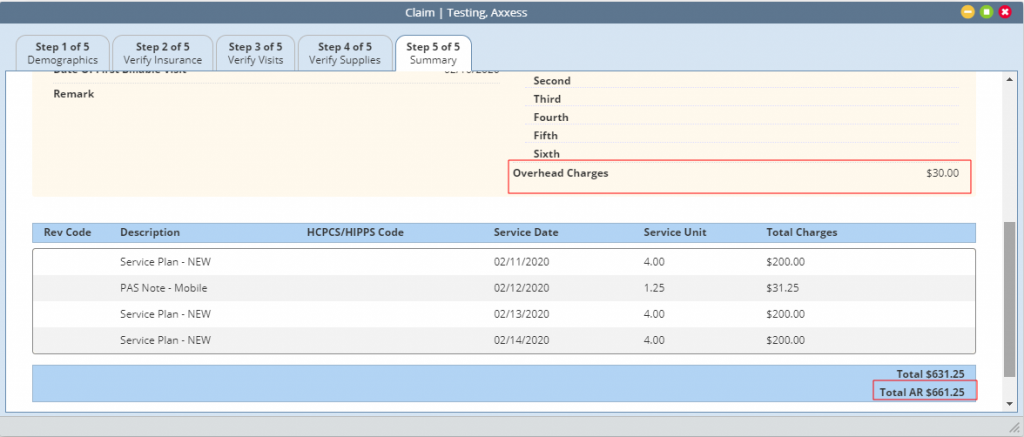

Billing ➜ Managed Care ➜ Outstanding Claims ➜ Claim ➜ Step 5 Summary

Step 5 of the claim verification process displays the total anticipated overhead revenue, claim total, and total combined payment.

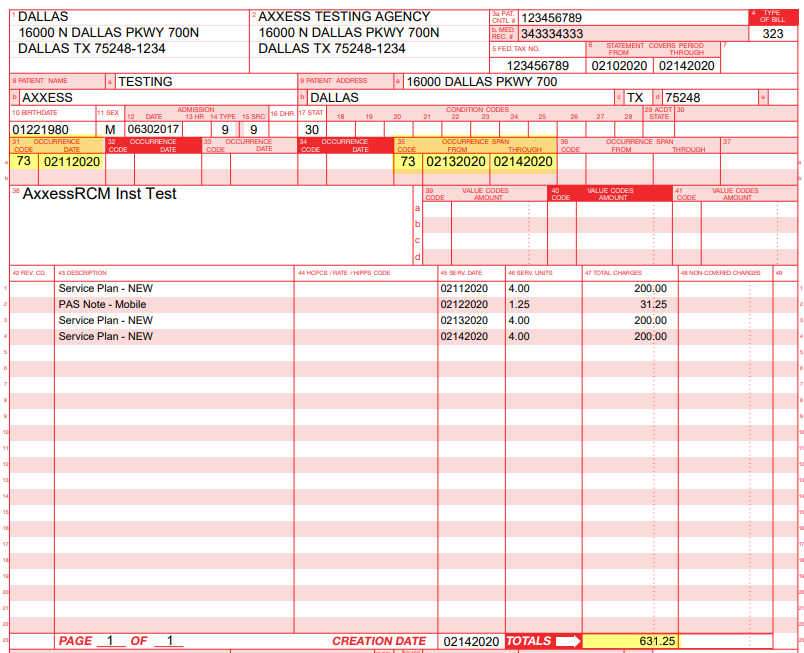

For each nonconsecutive date of service billed, the occurrence code and corresponding date will populate in locator fields 31a – 34b. For consecutive daily services billed, the occurrence code and corresponding date range will populate in locator fields 35a – 36b.

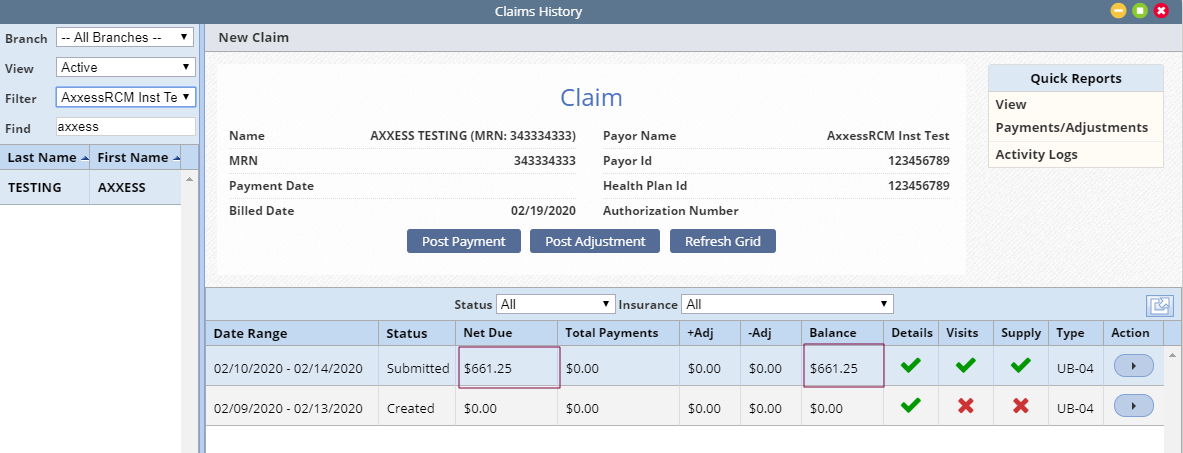

Billing ➜ Managed Care Claims ➜ Claims History ➜ Net Due

In Claims History, the Net Due column will reflect the occurrence code total and claim total. In the following example, a claim total of $631.25 is added to an occurrence code total of $30 for a net due amount of $661.25.

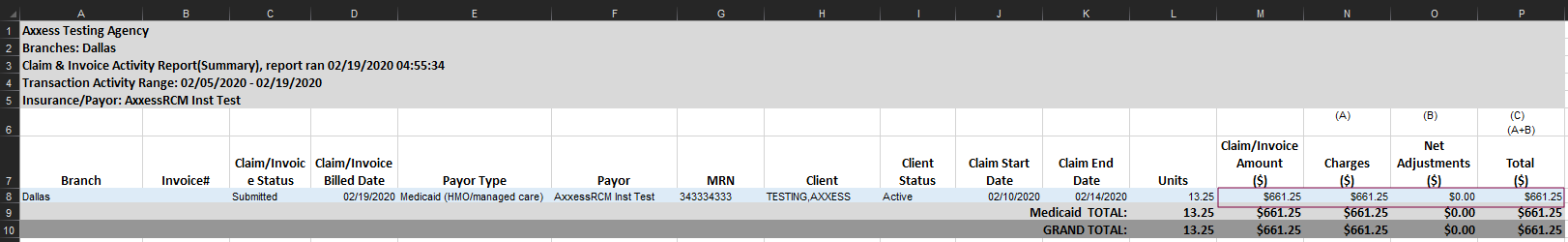

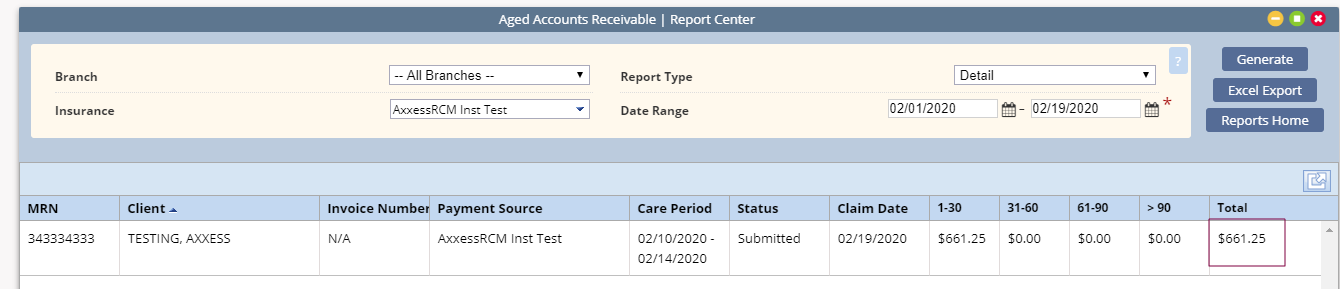

Financial reports that include net due amounts will display the combined overhead and claim totals. Examples include:

Claim and Invoice Activity Report

Aged Accounts Receivable Report

Updated on 2/20/2020